The latest in a series of scammers to come to our attention is DDC (Direct Debt Collections) who are well known to the UK Authorities. They claim to be acting on behalf of a ‘client’ which is Reflect Print but as always, this is just a ruse.

They send unsuspecting companies an invoice, hoping it will get paid and when it doesn’t, they send a Debt Collection letter from DDC who purport to be acting on behalf of Reflect Print.

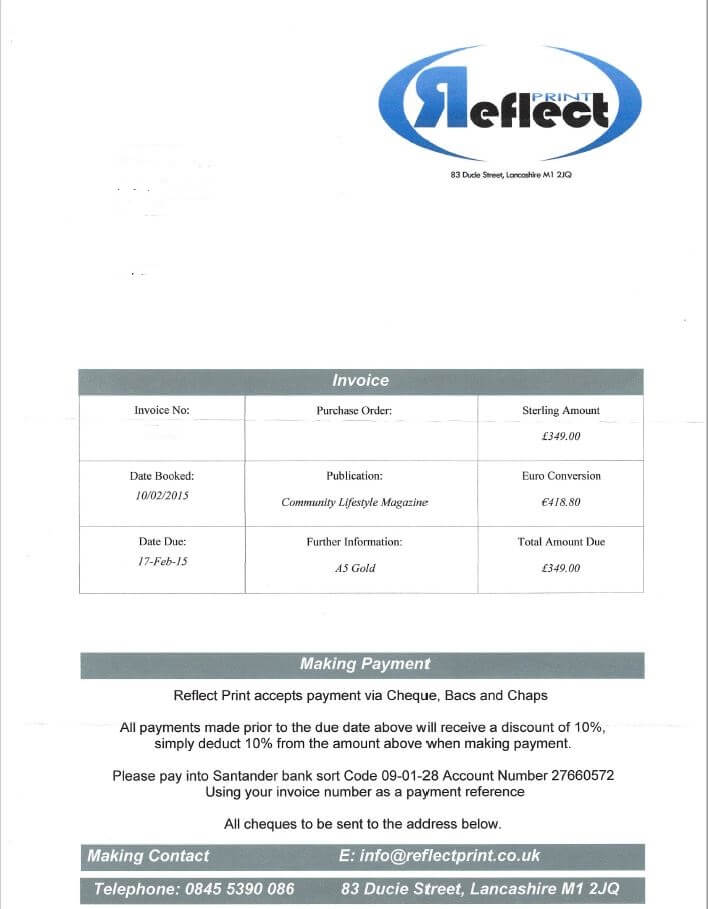

Reflect Print’s invoice claims to be for an entry into a magazine called ‘Community Lifestyle Magazine’ and the date of the entry is conveniently sufficiently distant so that most people can’t remember. In the case of our ‘target’ the date was back in early 2015.

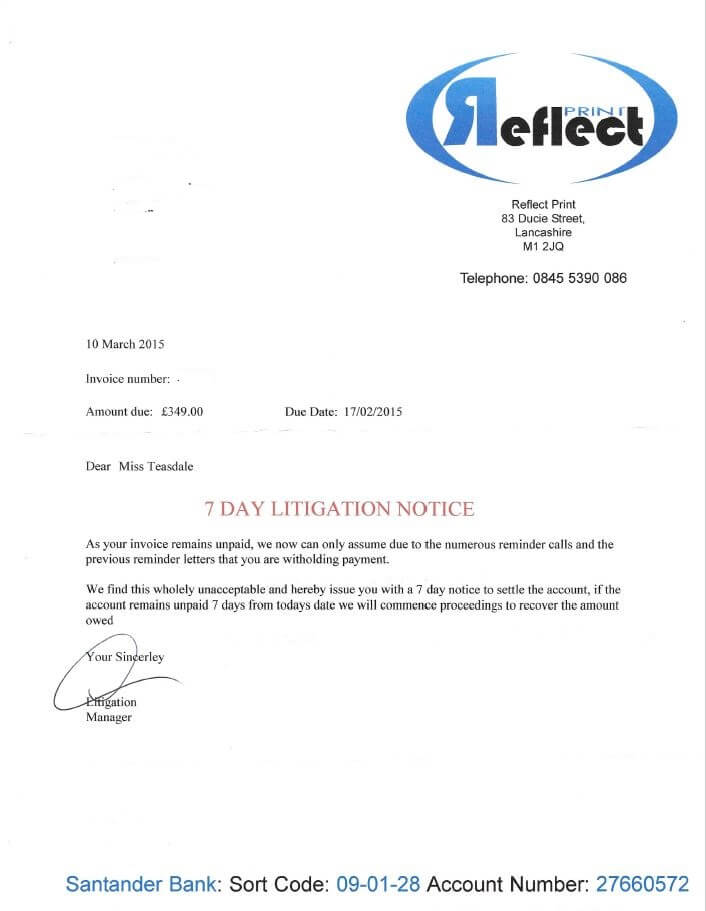

The cover letter from the Debt Collectors looks quite convincing and as you can see below, if you received this in the post you might think it was a genuine demand.

This is what the letter actually says;

YOUR ACCOUNT IS NOW WITH DDC DEBT COLLECTION SPECIALISTS

20 March 2015

Invoice number: XXXXXX

Dear XXXXXXXXXXX

Direct Debt Collections have been instructed by our client who’s invoice is enclosed to recover monies owing to them.

We hereby without prejudice give you seven days from the date above to make payment.

Failure to make payment within this time will result in an agent of direct debt collections visiting your premisis, this will automatically incur a further fee of £150 + vat which will be added to your account.

If at the time of the door step visit you are still unable to make payment our agent will serve upon you a court issued seizure notice and goods equivalent to the amount owed will be seized under paragraph 9 of schedule 7, section 99 of the Courts Act 2003.

To prevent the above action our client is prepared to offer a one off settlement offer to bring this issue to a conclusion, the offer is a reduction of 25% of the amount owed as per your enclosed invoice, however payment must be received within seven days of the date above.

You can pay the amount you owe directly into our clients Santander Bank account Sort Code 09-01-28 Account Number 27660572 Or you can post a cheque to 83 Ducie Street Manchester M1 2JQ

Yours sincerely

Mr A Miller Debt Recovery Director

07790299406

DO NOT IGNORE THIS LETTER

So, a rather threatening tone trying to claim a debt that is almost four years old.

The scammers have made a couple of errors on this, but most people will be sufficiently scared not to notice. We, however, like picking apart these kinds of details.

First, if we are being pedantic, the ‘who’s’ in line one really should be ‘whose’. Not the worst crime admittedly but an indication that all is not as it should be.

They compound this issue by failing to spell ‘premises’ correctly, preferring instead the never before seen variation of ‘premisis’.

They also threaten that “our agent will serve upon you a court issued seizure notice and goods equivalent to the amount owed will be seized under paragraph 9 of schedule 7, section 99 of the Courts Act 2003.”

If you look up this Act you will find the following;

Seizure of goods

9 (1) This paragraph applies where an enforcement officer or other person who is under a duty to execute the writ is executing it.

(2) The officer may, by virtue of the writ, seize—

(a) any goods of the execution debtor that are not exempt goods, and

(b) any money, banknotes, bills of exchange, promissory notes, bonds, specialties or securities for money belonging to the execution debtor.

(3) “Exempt goods” means—

(a) such tools, books, vehicles and other items of equipment as are necessary to the execution debtor for use personally by him in his employment, business or vocation;

(b) such clothing, bedding, furniture, household equipment and provisions as are necessary for satisfying the basic domestic needs of the execution debtor and his family.

The only problem they may have with this is that it first requires a writ to be issued by the Court and since the debt is imaginary and was never entered into by the client then no such writ would ever be issued.

In other words, the threat is empty.

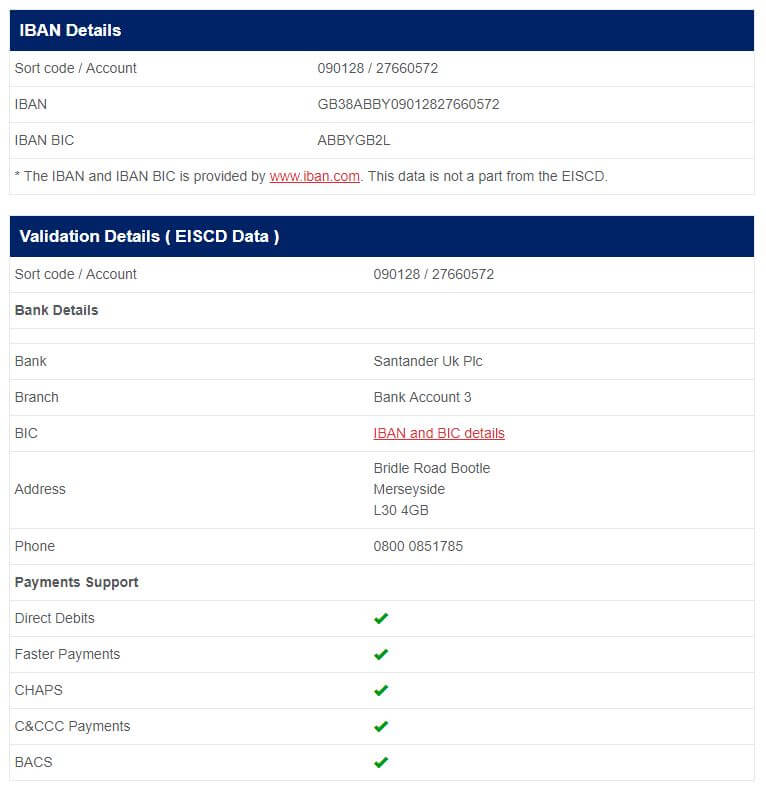

Why is the DCC Bank Account number the same as Reflect Print?

The final nail in the coffin to this scam is that they ask you to;

“pay the amount you owe directly into our clients Santander Bank account Sort Code 09-01-28 Account Number 27660572”

This is the tell-tale sign for us.

We’ve worked with a number of firms in this space over the years and the one thing they all have in common is that none of them work for free.

Not only do Debt Collectors add their fees onto the amount owed, but they also insist on being paid directly or they seize goods to the value of the debt outstanding, including their fees.

If you follow the instructions given here and pay directly into the bank account of this alleged printer, how would the Debt Collectors get paid?

It all seems a little odd when you pick it apart.

The Bank account is real enough; it’s still currently live and is a Santander account, administered through Bootle. Here are the details;

Of course, what this all adds up to is that these two are one and the same; Reflect Print and DCC are simply two names for the same scammers.

What is Community Lifestyle Magazine?

When you examine the invoice from Reflect Print you find that they claim to have put you into something called ‘Community Lifestyle Magazine’ but of course, any number of searches online fail to uncover this magazine. Primarily because it never existed.

There is a perfectly legitimate company who produce local magazines called Life Magazines however they only produce issues for Petersfield, Haslemere, Farnham and Godalming. Based in Hampshire these are part of the Tindle Newspapers Ltd group and this scam is nothing to do with them.

If you check the website attached to the email at the bottom – reflectprint.co.uk you will find that it’s dead and has never existed. It was once a parked domain but there doesn’t appear to be any trace of a website ever having existed.

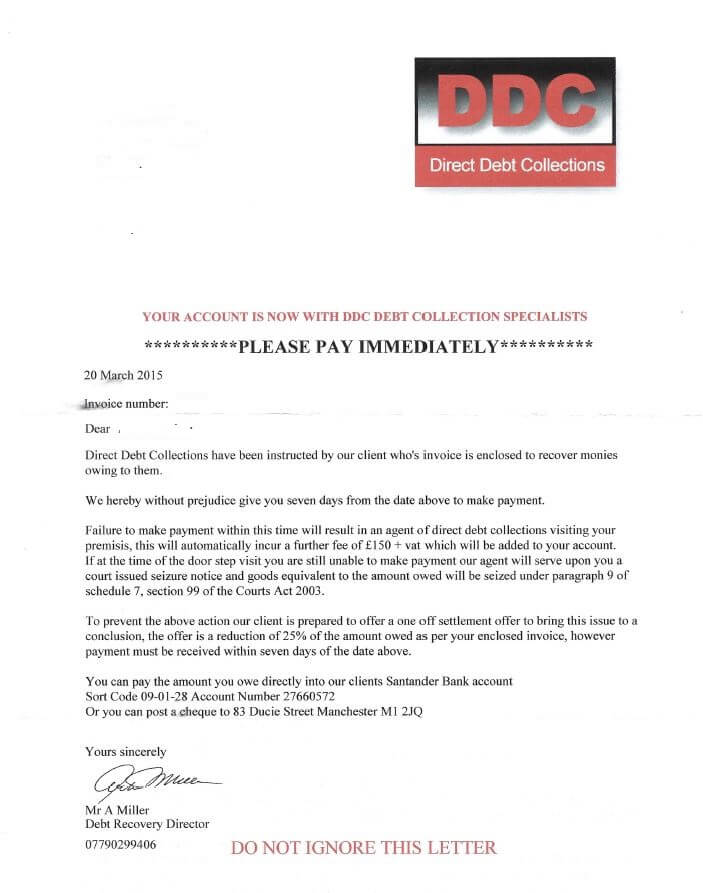

If you look closely at the Reflect Print covering letter you can also see that they have adopted a threatening tone but once again with a clear disregard for grammar.

They say;

7 DAY LITIGATION NOTICE

As your invoice remains unpaid, we now can only assume due to the numerous reminder calls and the previous reminder letters that you are witholding payment.

We find this wholely unacceptable and hereby issue you with a 7 day notice to settle the account, if the account remains unpaid 7 days from todays date we will commence proceedings to recover the amount owed

The incorrect use of ‘wholely’ instead of the correct ‘wholly’ along the missing apostrophe in today’s shows once again that this has been written by the same team.

The invoice they supply with it is also telling as it has on it the same bank details as the debt collection letter.

Who are DCC and what can you do if they write to you?

As we mentioned earlier, DCC are well known to the Authorities and the Financial Conduct Authority (FCA) actually list them as a ‘Clone Firm’.

Essentially, they pretend to be a legitimate registered and regulated company; in this case, it was fastsamedayloans.co.uk, at the same address of 83 Ducie Street, Manchester and then pursue people for imaginary debts.

You can read the details on the FCA website here. There are further details on what to do if they approach you on another FCA page here.

Now, we’re close enough to Manchester to be able to actually visit the address and we know, from experience, that it’s no more than an accommodation address.

Here’s a snapshot from Google Maps

The bottom line is that this is a scam and if you receive one of these letters here’s what to do;

DO NOT PAY IT!

Put the letters straight in the bin and think no more about it.

Alternatively, if you want to pursue them then feel free to contact the FCA and report them once again. The contact details are all on this webpage and the more people that report them the more likely it is that the FCA will take action. After all, they already know their bank account number….

Of course, if you want to let us know about it feel free to drop a comment below.